Disponible en anglais seulement.

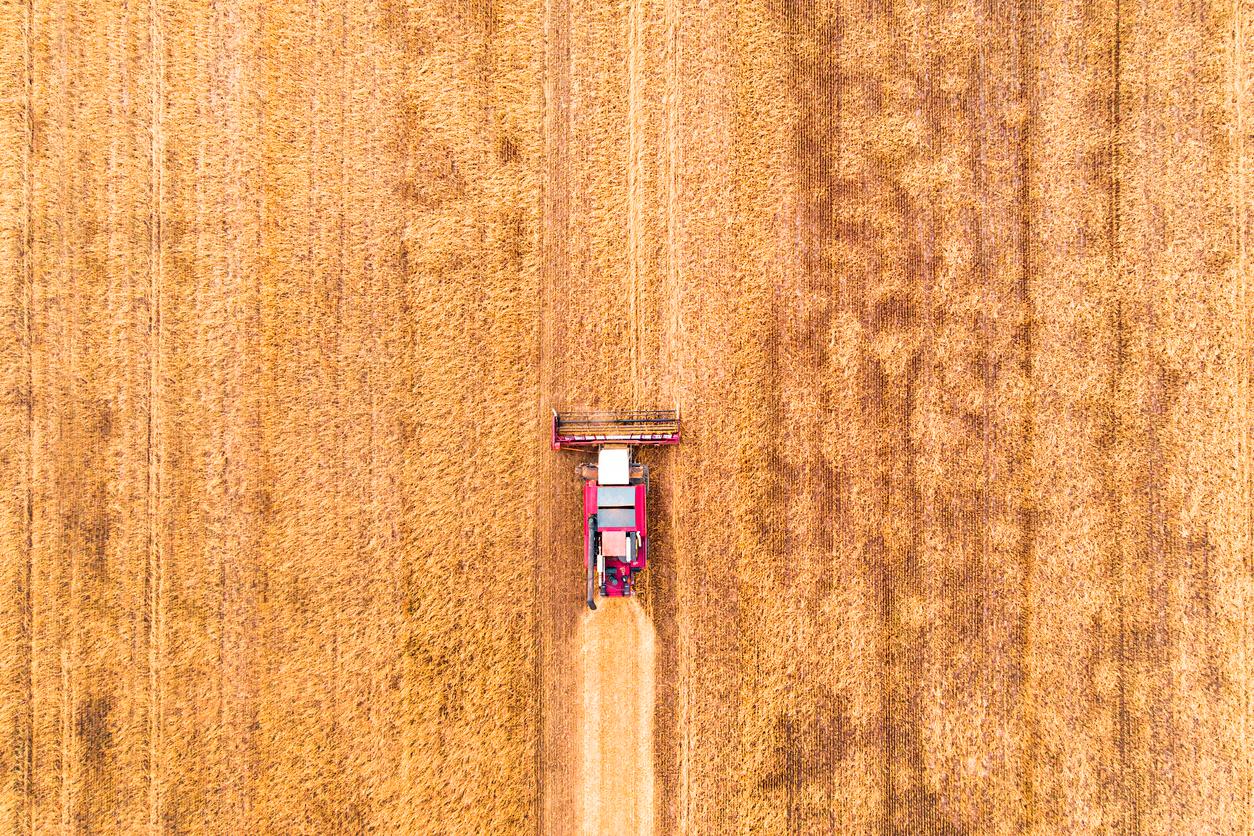

In this special episode from BMO’s IN Tune Podcast, host Camilla Sutton is joined by Joel Jackson who discusses why the conversations around the role of farming in carbon and emissions management are intensifying.

IN Tune features Equity Research analysts from BMO Capital Markets and explores key emerging themes, trends, and important issues to our institutional clients globally.

In this episode:

How agriculture-related GHG emissions are accounting for roughly a quarter of global emissions

While many hope no-till farming and cover cropping could prove a benefit to growers to monetize sustainability practices and lower emissions, they may prove to be a burden unless government and food industry incentives materially increase and broaden

Why BMO estimates a 5- to 10- year payback for a farmer transitioning to no-till and cover cropping

Sustainability Leaders podcast is live on all major channels, including Apple, Google and Spotify.

Subscribe to listen to other IN Tune episodes